Do you suffer from investment FOMO? The periodic table of investment returns can help.

Most people are not investment experts, and don’t have the time, inclination or energy to research and design the right mix of investments for their personal portfolio. Yet, with daily hype from the media or the unsolicited advice of friends who invested in a winning stock, you may still experience FOMO with your investing. This ‘fear of missing out’ on the most recent hot returns may cause you to make bad decisions or simply feel like you should be taking more risks. What you may actually be missing out on are the benefits of a well-built, disciplined financial plan, and portfolio construction designed to accomplish your specific goals.

When you ask, “How can I get the highest return in any given year without regard for the downside?” you fail to take into consideration your bigger picture. What aspirations do you have for you and your current or future family? How well-positioned are you to fund those goals? The more strategic question is to ask when it comes to your investments is, “What realistic return do I need to support my specific financial goals, and what level of volatility can my long-term plan and I tolerate?”

With investing, people often fall prey to recency bias where they expect recent strong returns of a certain investment or asset class (e.g. stocks, bonds, real estate) to persist consistently. In reality, events are random within their long-term patterns. For example, stocks tend to outperform bonds in the long run, but on any given day or year, this performance can vary dramatically on that path, among the asset classes and all the way down to the individual security level. Consider this non-financial example: Imagine a region of the world that experiences fairly reliable levels of rainfall annually. While the average rainfall amount may stay consistent, the days on which rain occurs is random, and once in a while, the region experiences floods or droughts that could swing the measurement in one direction or the other.

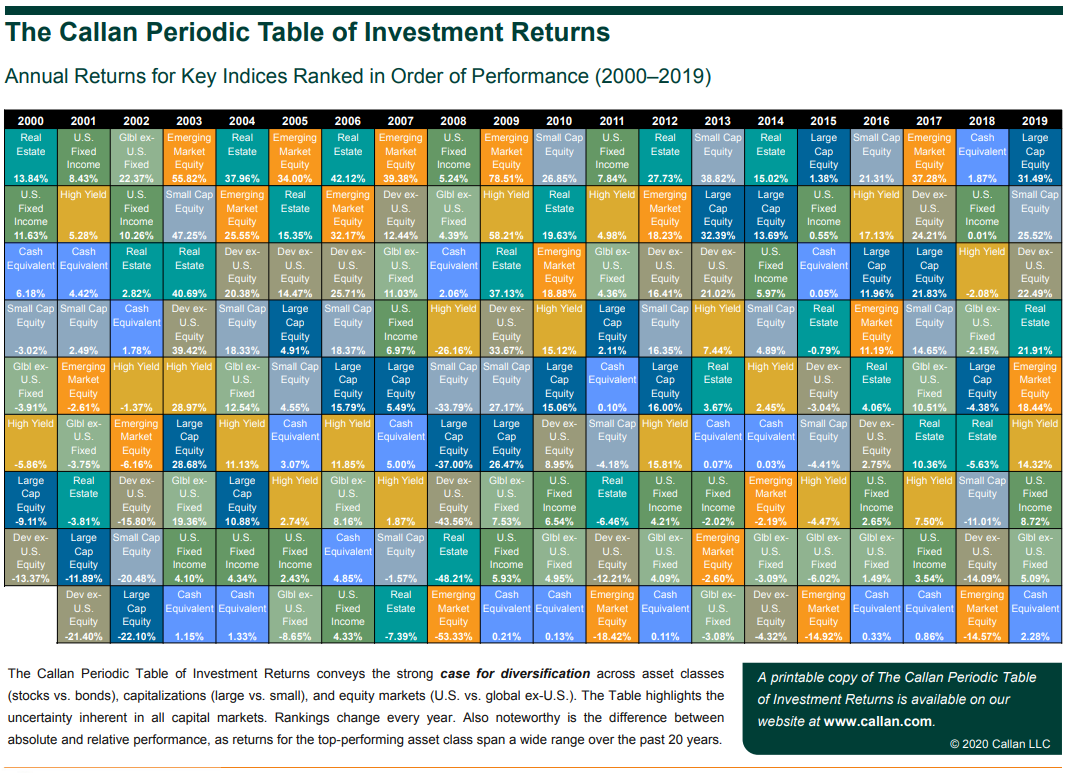

(The Callan Periodic Table of Investment Returns- CALLAN INSTITUTE)A great visual for this phenomenon is the periodic table of investment returns, showing ranked returns by year over 20 years. Glancing at it, you see a riot of color. As you examine it, you might find what appear to be patterns. With a closer look, you can see that there is no predictability. One year’s hottest performing asset class is at or near the bottom the following year (or vice versa!), but that’s not predictable either. Unfortunately, multiple investor behavior studies including work from Berkeley Haas Finance Professor Terrance Odean have shown that hopping around and chasing recent returns in hope of similar future returns can be hazardous to your wealth.

What this chart so elegantly summarizes is the benefit of diversification, a concept that won the Nobel Prize in Economics in 1990. When you hold a combination of asset classes, you always capture a portion of the highest returning asset classes and never have excessive exposure to the lowest-returning asset classes. This diversification helps smooth out returns over time. You will be able to plan more effectively and decrease the likelihood of emotional investing. In other words, diversification helps manage uncertainty.

One interesting mathematical fact displayed in this chart is that for a given level of investment return, the portfolio with lower volatility will have a higher compounding rate of return. This can lead to a better cumulative return and a less bumpy ride. The black squares represent one example of a diversified “balanced” portfolio [60% stock, 40% bond]. It’s never at the top, but it’s never worse than 4th from the bottom in this chart. A 70%/30% portfolio where the percentage of stock allocation increases would float higher in the chart, on average, with a bit more volatility. A lower stock mix (e.g. 50%/50%) would sit lower, on average.

Where your portfolio should fall on the chart — that is, the right level of diversification for you — is a question that WealthStep helps answer. Your mix should generally coincide with your life stage, with possible influence from your goals, risk tolerance, account balances, timeline and other factors (however the biggest factor for most people is whether or not they are saving the right amount).

The next time investing FOMO creeps in, remind yourself to ‘embrace, don’t chase.’ Embrace uncertainty with smart life-stage based decisions and smart planning and saving, and avoid the temptation to chase something that is already gone.