Blog

Quarterly Thoughts – Q1 2014

Are there clear patterns of investment market returns over time? How does a “balanced” portfolio compare to individual asset classes over time? Our chart entitled “The Periodic Table of Investment Returns – A Case for Diversification Amid Uncertainty” is a colorful illustration that addresses these questions. People are not naturally wired for investing. Without discipline, it is human nature to make mental errors, often due to “recency bias” and the…

Quarterly Thoughts – Q4 2013

Will a disciplined investment process improve your health? Recent research says yes. Stress caused by dramatic market movements, the financial press, and investors’ common behavioral mistakes can make people feel queasy… or worse. A March 2013 study by the University of California at San Diego found that hospitalizations rise on days when stock market prices fall. Another study published in the American Journal of Cardiology showed a significant correlation between…

Quarterly Thoughts – Q3 2013

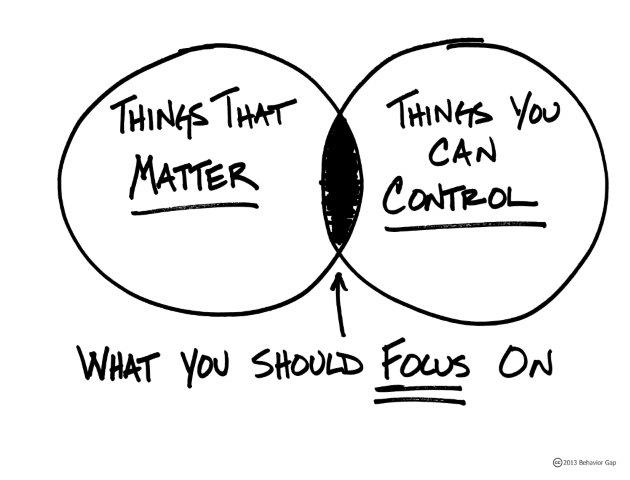

Consider focusing where you can make an impact, in terms of your life goals and financial goals. The simplicity of this diagram is profound. The world around us is complex and full of “noise,” both statistical and theatrical (e.g. TV news, etc.). The senses are bombarded with eye and ear-catching attempts to grab your attention. The challenge is to remain focused on what counts. Insufficient focus leads to distraction and…

Quarterly Thoughts – Q2 2013

In investing, “normal” is an elusive idea. Long-term average returns are relevant for planning, but rarely does a stock market calendar year return fall within a range of 2 percentage points around the average. If “normal” does exist in the stock and bond markets, it can be loosely defined as a predictably unpredictable sequence of short-term economic events, followed by investor over-reaction and the ensuing volatile returns in the market….

Quarterly Thoughts – Q1 2013

Market Volatility is the norm, not the exception. Yearly, we provide an updated version of the enclosed Periodic Table of Investment Returns. Given the recent global financial crisis and partial recovery market experience, the table is particularly timely, as it provides a broader perspective. This chart is a powerful visual demonstration of the unpredictability of investment returns across major asset classes, and indirectly illustrates the importance of diversification, discipline, rebalancing…

Quarterly Thoughts – Q4 2012

Despite the sluggish economy and the general perception that there has been limited progress after the global financial crisis, most stock markets rose 16% to 20% for the year, some market indices are now recording new highs, and the current U.S. stock market recovery, adjusted for inflation, is on track to be the fastest recovery amongst those that followed the four worst market crashes of all time. While this may…

Year-end 2012

Year-end is often a time of reflection and gratitude. Recent events make that difficult, but not impossible… The Sandy Hook tragedy makes our hearts ache. But, our hearts will not break, having seen the overwhelming response to the victims’ families and the possibility of the positive changes which may result from the experience. WealthStep’s mission is to influence and facilitate positive changes in the lives of our clients and in…

Quarterly Thoughts – Q3 2012

What does “safe” mean? When driving car or playing baseball, the answer is generally clear. When investing, the answer is less obvious. To get where you want to go financially, it is critical to properly frame the problem, by asking the right questions: safe “from what risk?” and “when?” Safe from volatility risk? Or interest rate risk? If so, at the expense of inflation risk (i.e. purchasing power)? Longevity risk…