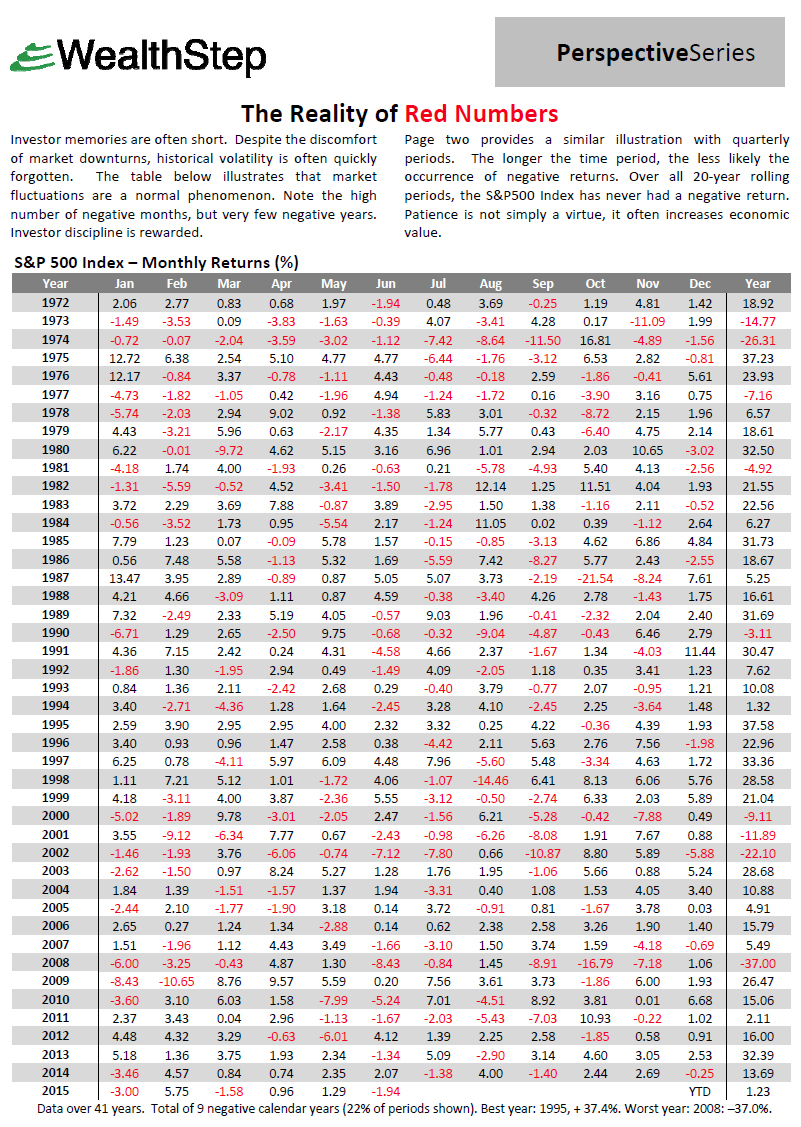

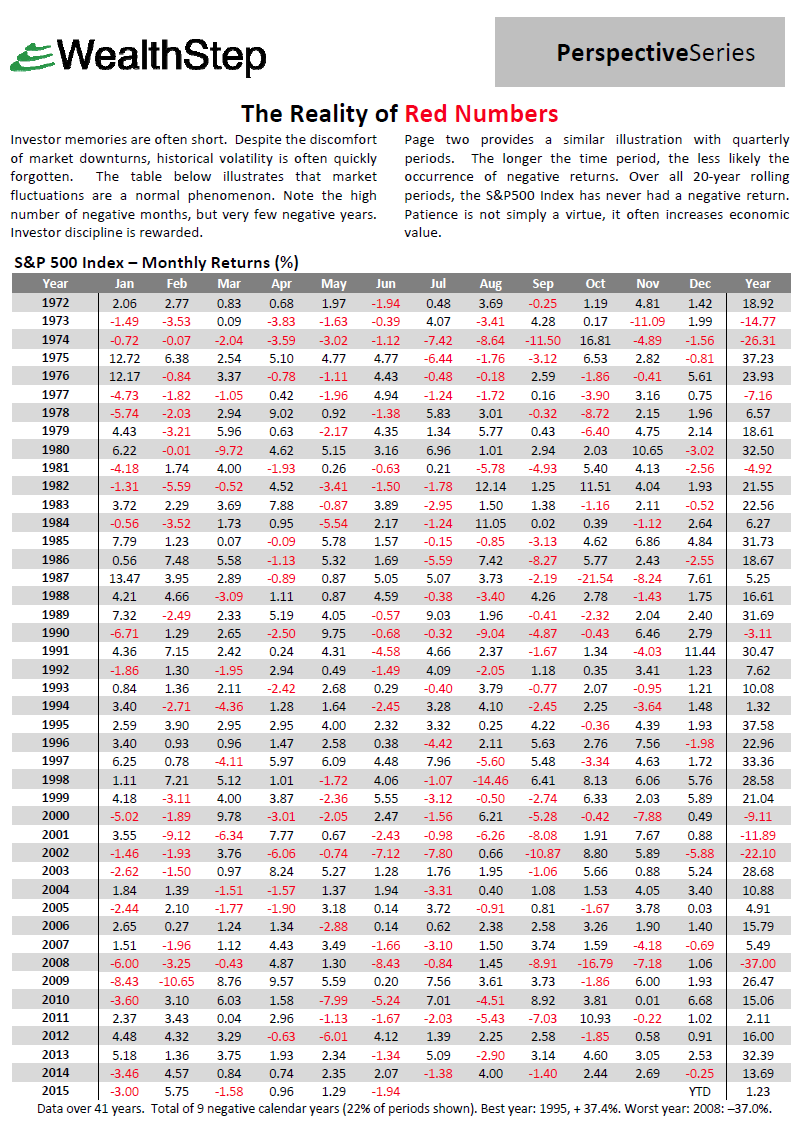

The Reality of Red Numbers

How often are monthly stock market returns negative? Is there a pattern within years or across years? How about the bond market? You may notice that short-term volatility is a fair price to pay… the longer the time period, the fewer the negative returns. In other words participation and patience pays. And, remember that inflation (i.e. purchasing power risk) is a bigger long-term risk than market volatility. Gain perspective from our yearly “Reality of Red Numbers” review.