Maybe spend more $ in early years of retirement

Good news… you may be able to spend more in the early years of retirement than you thought. Smart in-retirement spending approaches were always critical to not running out of money have always been important, but new studies on longevity and spending patterns of those in retirement shed new light on the subject.

You spend most of your life saving for retirement, so making sure the money is spent wisely merits attention too. Retirement spending strategies are an often overlooked component of successful financial planning.

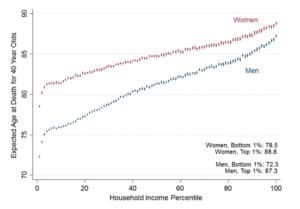

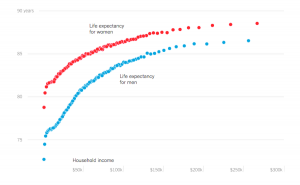

Data indicates that life expectancy has increased 1 year per decade since 1950. And, as per recent research from the Social Security Administration’s Health and Retirement study by the Brookings Institute, people with greater means tend to live longer… so that’s a good reason to build your wealth, but living longer also requires more and smarter spending in retirement, and therefore more planning and saving.

This doesn’t necessarily mean spending less in your first years of retirement, when you are likely the healthiest and most mobile, for travel or other activities… like tango lessons, personal retreats, or cultural safaris? Since people tend to spend gradually less on discretionary items in retirement, the right spending approach can allow for more spending at the beginning. natural decline in discretionary activity, and expenses, as we age.

But what about health care expenses? This is a bigger concern for those with lower incomes and savings, and less of a concern with greater means. The studies suggest that household spending on health care is often about 10% of income for people at age 65 and increases to 20% by age 85, including out-of-pocket costs and Medicare Part B and private Medigap plan premiums. Those health plans cover approximately 80% of total medical costs.

Beware of “straight line” projections that increase spending by inflation over the course of retirement, since that can be misleading, since it doesn’t always appropriately adjust for the factors above, and may not take full advantage of the nest-egg savings you worked (or are working) so hard to create. In other words, if you save wisely now, and spend wisely in retirement, you may be able to enjoy retirement even more than you thought!

Chart source: UCLA Center for Health Advancement, Life Expectancy, Suicide & Wealth ©2016