Blog

6 work from home tips we’ve learned so far

With the shelter in place in effect in Northern California since last Tuesday, and more places to come soon, many of having had to shift from going to the office to working from home. WealthStep is well set up to operate as a virtual office, and should not experience any interruptions. Here are a few remote tips we hope will help you. Make your life easier Upgrade your Internet service: Now…

Markets react to coronavirus: how to weather the challenges ahead

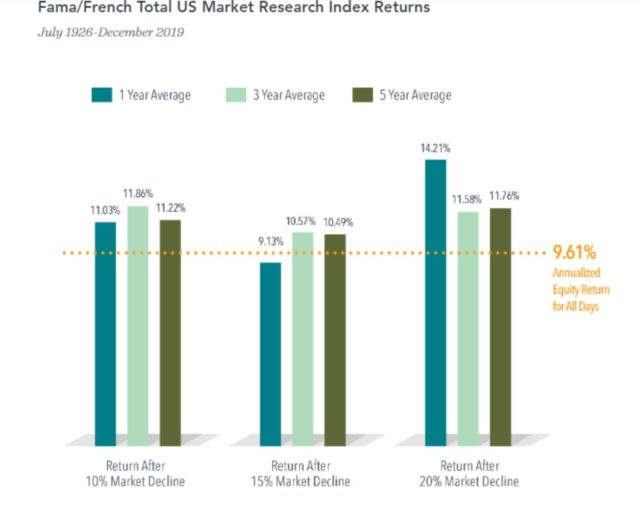

It’s been a difficult week and a half for investors, as the uncertain trajectory of COVID-19 upset people’s sense of well-being, public health systems and the financial markets. Coronavirus and its economic fallout, coupled with the Saudi/Russia oil tension, have created a unique mix of anxiety that makes markets particularly volatile. No one can predict what will happen over the short term, but we have confidence, based on past experience,…

How we’re thinking about coronavirus

The public’s concern about coronavirus (COVID-19) is increasing. As is often the case, concerns are frequently magnified by what’s called “negativity bias,” an evolutionary mechanism in the brain to minimize risk. More often than not, people over-react to potential risks. But sometimes the reaction is warranted. Regarding coronavirus, it is too soon to tell how justified these worries are, and the appropriate level of concern at any point in time…

Longevity’s ripple effect: Why Gen X cannot count on inheritances for their retirement

As if Gen X (now age 40 – 55) didn’t have enough to think about in midlife, they also need to be careful about including any expected inheritance in their retirement planning. While there is much talk about a great transfer of wealth in America in the coming 25 years, with estimates anywhere from $30 – $65 Trillion, this estimate and its timing is by no means a sure thing….

Q4-2019 Quarterly Context Webinar

What should you be training your brain to do now, given the longest bull-market ever? What are people doing with their better physical state later in life? Where are we in the business cycle now? What is the “Fed pivot” and how are market returns projections changing for the next 10 years? What does “growth recession” mean and is that the new normal? Where does the 2019 market return…

The SECURE Act: What individuals and business owners need to know

Business owners, especially smaller employers, now have more incentives and options to offer retirement savings plan. Individuals have additional opportunities to grow their retirement savings. Signed in to law by the President on December 20, 2019, The SECURE Act (‘Setting Every Community Up for Retirement Enhancement”) brings the most significant pension reform in more than a decade. The goal of the legislation is to promote retirement savings and affects both individual investors…

3 book recommendations

What are you going to read (or listen to) next? Whether you want to form new habits, create systems in a business, or preserve what’s meaningful to you, you can find answers in these books. Atomic Habits by James Clear James Clear, one of the world’s leading experts on habit formation, shares practical strategies in his book Atomic Habits that can be of particular interest to business owners, leaders, and entrepreneurs as you…

Is your company prepared for the next disaster?

Preparing your workplace for a natural disaster is as critical as preparing your home, yet many businesses do not have an emergency plan in place. In the Bay Area, earthquakes are a constant threat with no advanced warning, and the “new normal” of California fire season reminds us how devastating nature can be. Other regions have risks that are different but also dangerous. Whether or not the business and your…