Markets react to coronavirus: how to weather the challenges ahead

It’s been a difficult week and a half for investors, as the uncertain trajectory of COVID-19 upset people’s sense of well-being, public health systems and the financial markets. Coronavirus and its economic fallout, coupled with the Saudi/Russia oil tension, have created a unique mix of anxiety that makes markets particularly volatile.

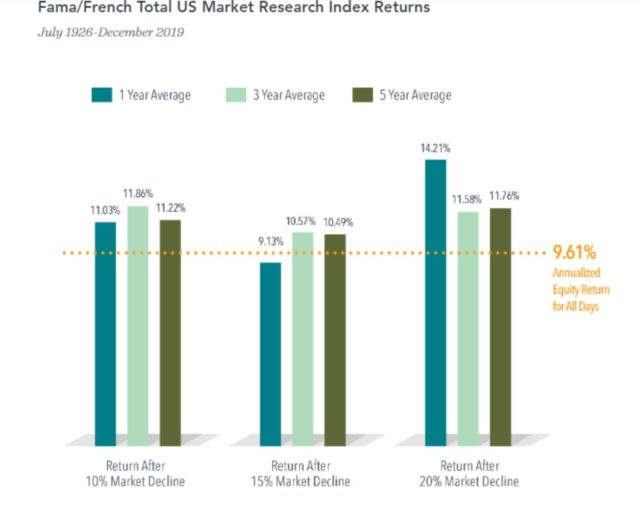

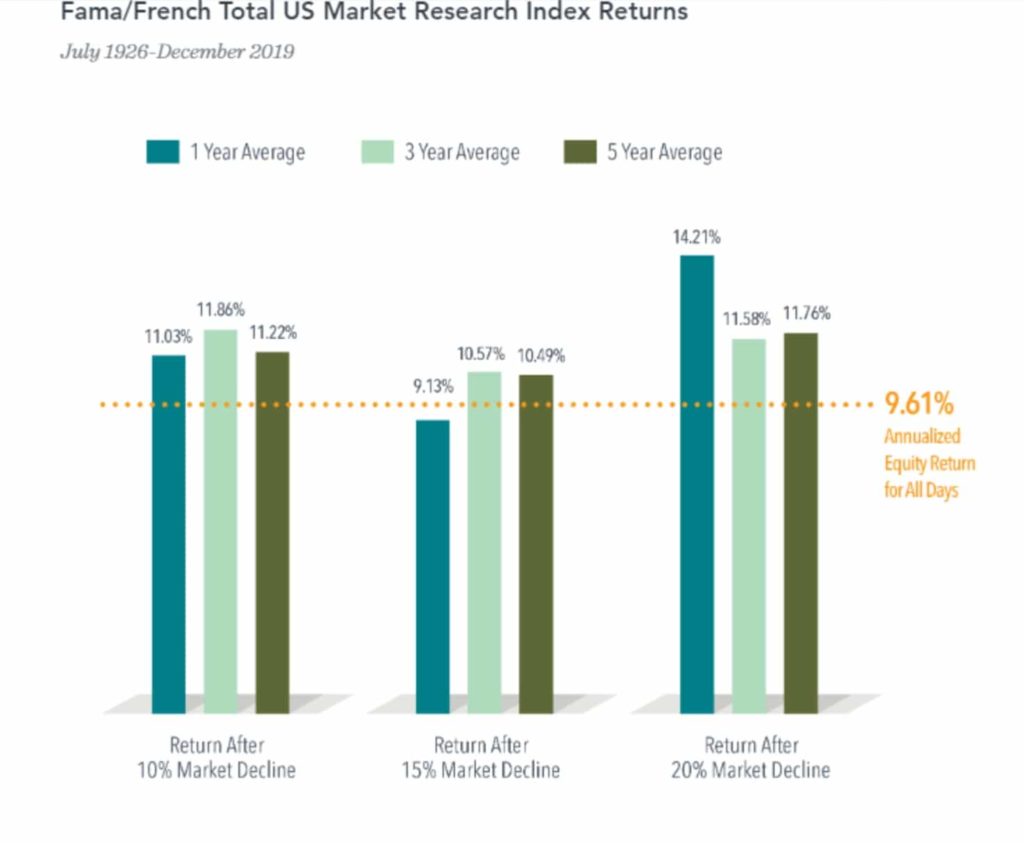

No one can predict what will happen over the short term, but we have confidence, based on past experience, that world and U.S. markets will be resilient over the longer term. Unlike the Global Financial Crisis in 2008, where the drivers were fundamental economic and structural issues with financial systems, the current, and rapid, event-driven drop in the markets is strongly linked to fear of the disruption caused by a virus. As market risk increases during a time of heightened uncertainty, so do the returns investors demand for bearing that risk, which pushes prices lower. Eventually investors are rewarded by staying in the market and bearing that risk, and it often does not take very long, as the chart here shows.

Having a well-diversified portfolio that has a stock/bond mix appropriate for your life stage means you can feel confident that about sticking with your plan, even when market volatility is extreme. Such market swings are not pleasant, but are expected to occur occasionally. What makes the current volatility even more challenging is that it comes after the longest “bull market” run in history, which caused many investors to forget that volatility is normal.

We expect that the weeks and possibly months ahead will continue to be unsettled as the anticipated spread of coronavirus continues. History has shown no reliable way to identify a market peak or bottom, and it is advisable not to make decisions based on fear or speculation, even as difficult and traumatic events transpire. Remember that all viruses have their natural progression, sometimes steeply increasing in infection cases before tapering off. Historically, many investors sold their investments in a panic near the peak of the virus infection curve, when fear is at its highest, only to regret it later, as the curve declined and investment prices bounced back, albeit unevenly.

You may find it encouraging that the near-30% stock market drop the experienced at certain points so far, added onto the 11-year bull market that preceded it, would still equate to a 9.4% average annual return, which is still several percent above the current projected annual return for stocks. In other words, stock valuations have been inflated, and a portion of this fear-driven selling is bringing long-term cumulative returns back within the expected range.

During these volatile times, WealthStep will update the blog every week or every other week, including a video in the coming days, to help you maintain perspective and keep your financial independence and retirement goals on track. Stay healthy and do what you can to help “flatten the curve” of the virus trajectory, it will help your family, your company, and your retirement account if everyone makes that effort.