Blog

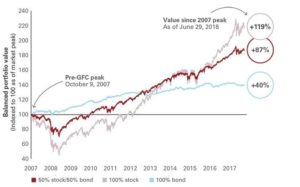

Now is a good time to learn the lessons from the Global Financial Crisis

As we hit the 10-year anniversary, there are lessons to learn from the economic challenges and 2nd worst market in history, and subsequent recovery, that began a decade ago. 10 years is long enough that some people don’t even remember this major financial event, while others feel like they are still recovering, given that the economy’s recovery has been gradual, even though the market’s recovery has been strong… maybe a…

Interest rates are shifting and will impact you… maybe more than any other economic indicator.

The Federal Reserve Bank’s Open Market Committee adjusts rates, down to stimulate the economy when needed, and up control inflation and prevent the economy from overheating during times of growth. In the first several years after the Great Recession, people thought little about rates. The Fed’s target rate fell to 0% late in 2008 and stayed at 0% for 7 years. Such extended periods of low rates is highly uncommon,…

Q2-2018 Market Review

Summer months are typically a quiet time for the markets. Recent events, however, may disrupt this tradition. Threats of escalating trade wars have cast a pall over equities, and numerous geopolitical uncertainties continue to push investors toward a more cautious stance. A desynchronization in global growth as well as a divergence in central banks’ monetary policies have contributed to U.S. dollar strength and wreaked havoc on emerging markets. Currencies of emerging…

Current market volatility is an investor test, not a market test

After years of unusually low market volatility that hypnotized a large swath of investors into believing yet again that markets only rise, the market drops of the last 2 days are a healthy reminder that stock market fluctuations should be viewed as a normal part of investing. Don’t forget, as is the case with food, good nutrition isn’t always tasty, but is beneficial in the long run. Eat your Brussels sprouts! As disciplined institutional investor Warren Buffet wisely said a while back, “The stock market is a device to transfer wealth from the impatient to the patient.” So, the real question is… do you want to be in the panic (impatient) group? Or the profit (patient) group?