Current market volatility is an investor test, not a market test

After years of unusually low market volatility that hypnotized a large swath of investors into believing yet again that markets only rise, the market drops of the last 2 days are a healthy reminder that stock market fluctuations should be viewed as a normal part of investing. Don’t forget, as is the case with food, good nutrition isn’t always tasty, but is beneficial in the long run. Eat your Brussels sprouts!

A pick-up in volatility shouldn’t surprise anyone that has been paying attention. Wage rates are growing, inflation increasing, inflation expectations are rising, the market hit many new highs in the last year, and the VIX volatility index was under 10 over 50 times in 2017, whereas the next highest was 1993 with only 4 days under 10. Also in 2017, for the first time ever, the S&P was up every month… that’s simply not normal. For quite some time, in our Quarterly Context webinars, we’ve been reminding clients to expect an increase in volatility.

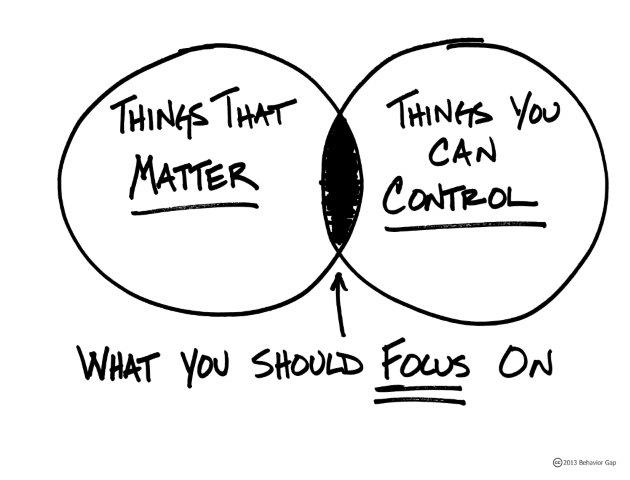

In our view, these market bumps are an investor test, not a test of the markets. Those who understand historical patterns react differently to the present. The greedy and those that are “skilled forgetters” who believed their risk tolerance was higher than it is, or are in the spending stage of their life but did not take advice to maintain a spending cash reserve, and instead took take more risk than was necessary to reach their goals are now more aware of the pains of , are now reminded of the pains of avarice. Those who follow a well-planned strategy may feel the same emotions, but react differently and have a different long-term result than the average person.

With the average investor reacting emotionally to markets, and driving the market fluctuations, it can be unnerving even for disciplined investors to observe market movements, but such movements are a natural part of the economy and market system. The following perspective may help:

- Headlines yesterday shouted that the market had the largest point drop in history. However, points are not the same as percentages. On a % basis, yesterday’s 4.6% decline would rank would rank 108th over history. Not a great good day, but not close to the worst.

- The market has seen an average of 3.4 annual declines of 5% or more, since 1928.

- A market correction, defined as a 10% drop or more, are common. The world stock market has dropped from top to bottom by more than 10% in 2/3 of all years since 1979, but still ended those years with a positive return.

- Some investors may incorrectly assume that all drops lead to massive drops, since the Global Financial Crisis market of 2008 still looms large in people’s memories, where US stocks dropped over 50%. In reality, corrections typically last 20-104 trading days.

- Volatility is good for investors in the long-run. Stocks must provide higher returns than cash or bonds over time, to be appealing to and compensate investors for volatility risk. The risk/reward relationship is a key part of economic and investment principles.

- Market fluctuations create lower-price buying opportunities for those who adding money to their long-term pools, and when rebalancing. Studies show that disciplined rebalancing boosts returns in long run.

- Volatility is just one type of risk and isn’t the worst risk int the long-run (especially for those not in spending phase) – inflation, emotional investing and longevity risk (the risk of running out of money before one runs out of time) are often more harmful.

Since the past tends to repeat itself, or at least rhymes, it’s probable that markets will remain bumpy for a while, and it might get worse before it gets better. Remember, however, that post-drop bouncebacks are also common, happen fast, and their timing can’t be predicted… so you have to be in it to win it.

As disciplined institutional investor Warren Buffet wisely said a while back, “The stock market is a device to transfer wealth from the impatient to the patient.” So, the real question is… do you want to be in the panic (impatient) group? Or the profit (patient) group?

If your stock/bond mix, i.e. asset allocation fits your life stage and needs, stay disciplined. Investors need to make a rational and intentional choice, rather than letting emotions dictate outcomes.

Whenever your goal change, it is always a good time to revisit your investments and see if a different stock/bond mix is better for your life stage or plan. If not, when the weather is stormy, it makes sense to stay home rather than abandoning your house, since it is designed to weather the elements over time.

For a WealthStep financial smarts education video, including how to think about market volatility: YouTube

For additional commentary articles of interest and comments not provided in WealthStep’s blog, follow us on LinkedIn, Facebook, Twitter.