Q4-2019 Quarterly Context Webinar

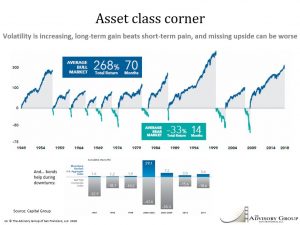

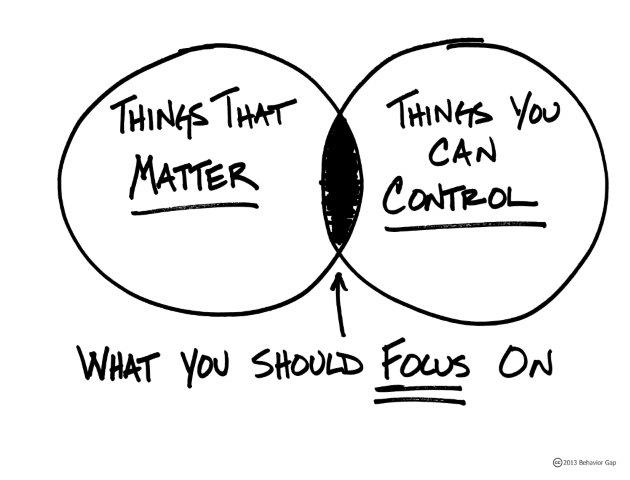

What should you be training your brain to do now, given the longest bull-market ever? What are people doing with their better physical state later in life? Where are we in the business cycle now? What is the “Fed pivot” and how are market returns projections changing for the next 10 years? What does “growth recession” mean and is that the new normal? Where does the 2019 market return…